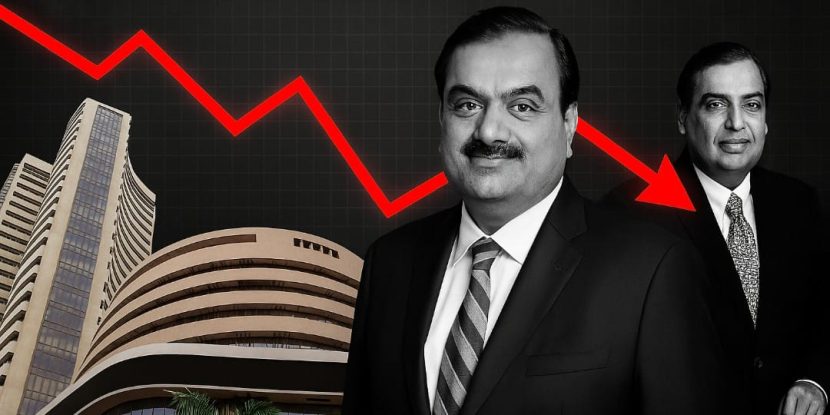

India’s wealthiest individuals suffered a significant financial blow on Monday, April 7, 2025, as the stock market witnessed a sharp selloff, eroding $10.3 billion from the net worth of the country’s top four billionaires. This downturn was fueled by global trade tensions and fears of a U.S. recession, which triggered widespread market volatility.

Who Were the Biggest Losers?

Mukesh Ambani: The chairman of Reliance Industries lost $3.6 billion, reducing his net worth to $87.7 billion.

Gautam Adani: The head of the Adani Group suffered a $3 billion loss, bringing his fortune down to $57.3 billion.

Savitri Jindal & Family: Their wealth declined by $2.2 billion, leaving them with a net worth of $33.9 billion.

Shiv Nadar: The founder of HCL Technologies saw his fortune shrink by $1.5 billion to $30.9 billion.

What Caused the Market Crash?

Global Trade Tensions

The global markets currently face heightened uncertainty due to President Trump’s recent tariff measures. Specifically, these reciprocal tariffs target imports from multiple countries, disrupting international trade flows. Moreover, they’ve intensified concerns about a prolonged trade war. Consequently, investor sentiment has weakened dramatically, leading to increased volatility across equity markets worldwide.

Recession Fears in the U.S.

Meanwhile, growing worries about America’s economic slowdown are compounding investor anxiety. Notably, key indicators – including declining consumer spending and slowing GDP growth – now clearly suggest a potential U.S. recession. As a result, foreign investors are rapidly withdrawing funds from emerging markets. In particular, India has seen significant outflows, further pressuring domestic indices.

Broad-Based Selling

India’s markets experienced a severe downturn, with the Sensex plunging 3,900 points while the Nifty fell below the critical 22,000 mark. Most dramatically, sectoral indices suffered heavy losses: Nifty Metal dropped 8% and Nifty IT declined 7%. Ultimately, three primary factors drove this selloff: first, weak earnings reports; second, elevated valuations; and finally, substantial foreign outflows. Therefore, retail investors ultimately bore the brunt of these significant losses.

Broader Implications

The recent selloff has not only impacted India’s wealthiest individuals but has also dealt a heavy blow to retail investors and small-cap stocks. Mid-cap indices fell by 7.3%, while small-cap indices declined by 10%, reflecting widespread losses across the market. Consequently, this downturn is expected to dampen consumer spending, which accounts for nearly half of India’s GDP, further slowing economic growth. Analysts caution that reduced household investments and weaker urban consumption could exacerbate the country’s economic challenges in the coming months.

Global Perspective

While Indian markets suffered significant losses, global markets also faced turbulence. Notably, Warren Buffett emerged as an exception during this period of market volatility, adding $12.7 billion to his wealth despite the broader downturn. This contrast highlights the varying impacts of market conditions on different regions and investment strategies. As global trade tensions and recession fears continue to shape investor behavior, the resilience of certain sectors and individuals underscores the importance of diversification in navigating uncertain times.

What Lies Ahead?

Market experts emphasize the importance of patience during this volatile phase. Dr. V.K. Vijayakumar from Geojit Financial Services highlights that India’s exposure to U.S. tariffs remains limited, accounting for only 2% of GDP. Additionally, ongoing negotiations for a bilateral trade agreement with the U.S. could help mitigate some of the adverse impacts on India’s economy.

The recent market crash underscores how global economic shifts can ripple through financial markets, impacting even the wealthiest individuals and broader economies. As uncertainties persist, investors are advised to focus on long-term strategies rather than reacting impulsively to short-term fluctuations.