Introduction

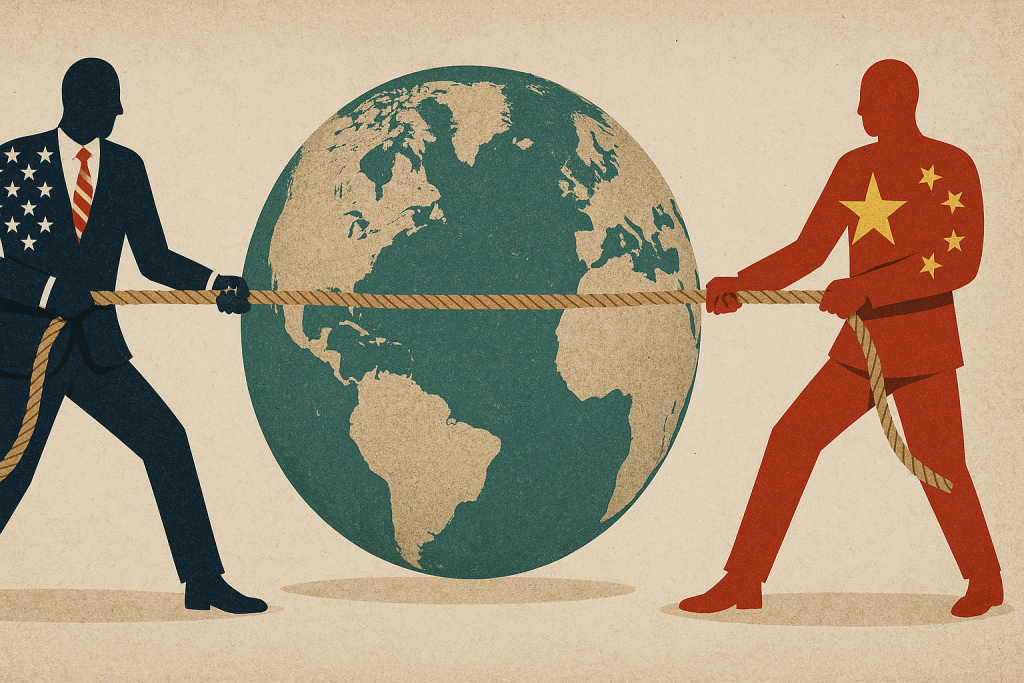

The escalating U.S.-China trade war has reached unprecedented levels in 2025, with reciprocal tariffs destabilizing global markets and reshaping economic alliances. The U.S. imposed a 145% tariff on Chinese goods, while China retaliated with 125% tariffs on American imports. This clash threatens to unravel decades of trade interdependence, with ripple effects across industries and nations.

The Tariff Escalation

- U.S. Tariffs: The 145% rate combines a 125% levy introduced in April 2025 with a 20% duty tied to China’s alleged role in the fentanyl crisis. This follows earlier rounds of 10% tariffs in January 2025.

- China’s Retaliation: Beijing raised tariffs from 84% to 125%, targeting $500 billion in bilateral trade. It also restricted rare-earth mineral exports and blacklisted 11 U.S. firms.

Global Markets React

- U.S. stock futures plummeted: Dow (-23%), S&P 500 (-2.4%), and Nasdaq (-2.7%). European and Asian markets fell over 3%, marking their worst performance in years.

- The IMF warns of a 0.5% reduction in global GDP, equating to hundreds of billions in lost output and widespread job cuts.

Impact on the Global Economy

Supply Chain Disruptions

- Companies relying on Chinese manufacturing face 54% U.S. tariffs on imports, forcing costly relocations.

For instance, U.S.-based tech firm ‘Tech Nova’ announced plans to relocate its manufacturing unit from Shenzhen to Vietnam within 90 days, citing unsustainable tariff costs.

- Rare-earth export controls (e.g., samarium, gadolinium) threaten tech sectors, including EV and semiconductor production.

Inflation and Consumer Costs

- U.S. goods in China are now “economically unviable,” per Beijing’s Finance Ministry. American consumers face price hikes on electronics, apparel, and machinery.

Diplomatic Fracturing

- China is courting European and Asian allies to counter U.S. pressure but faces limited success.

- The EU, caught in the crossfire, risks losing access to critical Chinese materials while navigating weakened transatlantic ties.

India’s Balancing Act

Opportunities

- Textile and Apparel Gains: The U.S. pause on Indian tariffs for 90 days allows exporters to capture a share of China’s $30 billion textile market.

- Tech Manufacturing: Global semiconductor shortages could accelerate India’s push for domestic chip production.

Challenges

- Diamond Sector Crisis: A 26% U.S. tariff jeopardizes India’s $10 billion diamond exports, risking thousands of jobs.

- Growth Revisions: Economists cut India’s 2025/26 GDP forecast by 20–40 basis points to 6.1%, citing reduced global demand.

Government Response

- Officials remain cautiously optimistic, maintaining a 6.3–6.8% growth target if oil stays below $70/barrel.

- Export subsidies are under consideration for affected industries like gems and pharmaceuticals.

The Road Ahead

The U.S.-China standoff has evolved into a “messy divorce,” with both sides refusing to back down. While India and other nations scramble to adapt, the broader risks—stagnant growth, inflationary pressures, and fractured alliances—underscore the need for multilateral dialogue. As Beijing vows to “fight to the end”, the world economy braces for a prolonged period of uncertainty, where short-term gains for some may come at the cost of long-term stability for all.